Introduction

Pursuing higher education is a significant step toward a brighter future, but the rising costs of tuition, accommodation, and other expenses can pose a financial challenge for many Indian families.

Education loans bridge this gap, enabling students to achieve their academic dreams without immediate financial strain. In India, banks like State Bank of India (SBI), HDFC Bank, Axis Bank, and Punjab National Bank (PNB) offer a variety of education loan schemes tailored to different needs, whether for studies in India or abroad.

A critical factor in choosing the right loan is the interest rate, as it directly impacts the total cost of borrowing. This comprehensive guide compares the interest rates and key features of education loans from these four major banks, designed to help beginners in India make informed decisions. education loan interest rates.

Understanding Education Loans in India

Education loans are specialized financial products that cover expenses related to higher education, such as tuition fees, hostel charges, books, and even travel costs for international studies.

These loans typically include a moratorium period, which is the course duration plus an additional 6 to 12 months, during which borrowers are not required to make repayments.

This allows students to focus on their studies without the pressure of immediate loan repayments. After the moratorium, repayment begins, often with tenures extending up to 15 years, depending on the bank and loan amount.

Interest rates on education loans can be fixed or floating, with floating rates tied to benchmarks like the Marginal Cost of Funds Based Lending Rate (MCLR) or Repo Linked Lending Rate (RLLR).

Rates vary based on factors such as the loan amount, the reputation of the educational institution, and the borrower’s or co-applicant’s credit profile. Additionally, government schemes like the Central Sector Interest Subsidy Scheme (CSIS) may provide interest relief for eligible students from economically weaker sections.

Eligibility Criteria

To qualify for an education loan, students typically need to:

- Be Indian citizens.

- Have secured admission to a recognized course or institution (via merit or entrance exams).

- Have a co-applicant (parent, guardian, or spouse) with a stable income.

- Meet minimum academic requirements (e.g., 50% marks in HSC or graduation for some banks).

Repayment Options

Repayment usually starts after the moratorium period, with options to pay simple interest during the course to reduce the overall burden. Some banks offer flexible repayment plans, including step-up or step-down EMIs, to suit the borrower’s financial situation post-education.

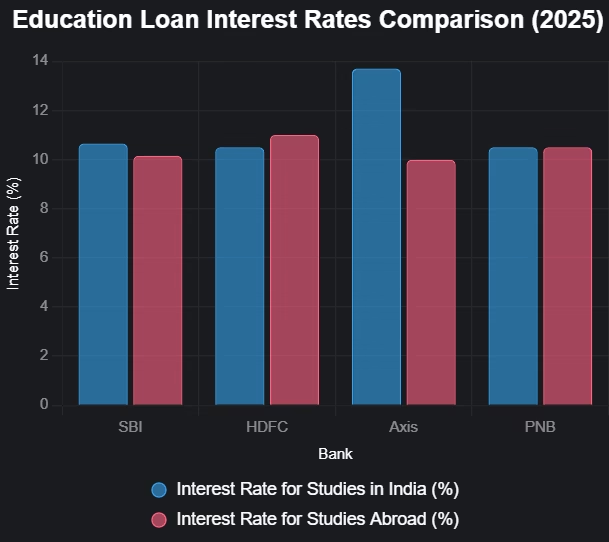

Detailed Comparison of Interest Rates

Interest rates are a pivotal consideration when selecting an education loan, as they determine the total cost over the loan’s tenure. Below is a detailed comparison of the interest rates offered by SBI, HDFC, Axis, and PNB for their education loan schemes in 2025, based on available data.

State Bank of India (SBI)

SBI is a leading public sector bank known for its competitive education loan offerings. Its schemes cater to various student needs, with rates varying by institution and study location:

| Scheme | Interest Rate (% p.a.) | Key Features |

|---|---|---|

| SBI Student Loan Scheme | 10.15% – 11.15% | For general higher education in India or abroad; no margin up to ₹4 lakh. |

| SBI Scholar Loan Scheme | 8.15% – 8.90% | For premier institutions (e.g., IITs, IIMs); lower rates for top-tier institutes. |

| SBI Global Ed-Vantage Scheme | 9.65% – 10.15% | For studies abroad; loan amounts up to ₹1.5 crore. |

| SBI Skill Loan Scheme | 10.65% | For vocational and skill development courses; max loan ₹1.5 lakh. |

Concessions: 0.50% discount for female students and those opting for SBI Rinn Raksha policy.

HDFC Bank

HDFC Bank, a major private sector player, offers flexible education loans with rates that depend on the borrower’s profile and study destination:

| Scheme | Interest Rate (% p.a.) | Key Features |

|---|---|---|

| Education Loan (India) | 10.50% onwards | Covers studies in India; no processing fee for Indian loans. |

| Education Loan (Abroad) | 9.55% – 13.25% | For international studies; rates vary by course, university, and credit profile. |

Note: Rates are linked to HDFC’s Credila Benchmark Lending Rate (CBLR), with a spread based on factors like academic background and co-applicant’s credit history.

HDFC Ltd Home Loan Interest Rates 2025 ?

Axis Bank

Axis Bank provides education loans with rates that vary significantly based on loan amount and study location:

| Scheme | Interest Rate (% p.a.) | Key Features |

|---|---|---|

| Education Loan (India) | 9.99% – 15.20% | Up to ₹4 lakh: 15.20%; ₹4-7 lakh: 14.70%; >₹7 lakh: 13.70%. |

| Education Loan (Abroad) | 9.99% onwards | Competitive rates for international studies; no upper loan limit. |

Note: Rates can be negotiated based on the student’s profile and institution.

Punjab National Bank (PNB)

PNB offers a range of education loan schemes with competitive rates, particularly for premier institutions:

| Scheme | Interest Rate (% p.a.) | Key Features |

|---|---|---|

| PNB Saraswati | 10.00% – 10.75% | For studies in India; up to ₹10 lakh. |

| PNB Pratibha | 8.20% – 10.50% | For premier institutions (e.g., IITs, IIMs); lower rates for top students. |

| PNB Udaan | 10.00% – 11.25% | For studies abroad; no upper loan limit. |

| PNB Kaushal | 10.25% – 10.75% | For vocational courses; up to ₹1.5 lakh. |

| PNB Honhaar | 11.25% | For specific courses; flexible terms. |

| PNB Pravasi Shiksha Loan | 11.25% | For OCI/PIO students studying in India. |

| PNB PM CARES Education Loan | 9.50% – 10.00% | For children affected by COVID; concessional rates. |

Concessions: 0.50% discount for female applicants and additional concessions for students with disabilities.

Interest Rate Comparison Table

The following table summarizes the typical interest rates for standard education loans in India and abroad:

| Bank | Studies in India (% p.a.) | Studies Abroad (% p.a.) |

|---|---|---|

| SBI | 10.15% – 11.15% | 9.65% – 10.15% |

| HDFC | 10.50% onwards | 9.55% – 13.25% |

| Axis Bank | 9.99% – 15.20% | 9.99% onwards |

| PNB | 10.00% – 10.75% | 10.00% – 11.25% |

Note: Rates are indicative and subject to change. Always verify with the bank for the latest rates.

Other Factors to Consider

While interest rates are crucial, other factors significantly impact the overall cost and suitability of an education loan. Below are key considerations:

Processing Fees

Processing fees can add to the upfront cost of borrowing:

| Bank | Processing Fee |

|---|---|

| SBI | Nil for loans up to ₹20 lakh |

| HDFC | Nil for Indian education loans; up to 2% for others |

| Axis Bank | Up to 2% of loan amount + GST |

| PNB | Up to 1% for overseas loans |

Loan Amount Limits

The maximum loan amount varies by bank and scheme:

| Bank | Studies in India | Studies Abroad |

|---|---|---|

| SBI | Up to ₹10 lakh (standard) | Up to ₹1.5 crore |

| HDFC | Up to ₹150 lakh | Up to ₹150 lakh |

| Axis Bank | No upper limit (from ₹50,000) | No upper limit |

| PNB | Up to ₹10 lakh (Saraswati) | No upper limit (Udaan) |

Moratorium Period

All four banks offer a moratorium period, typically the course duration plus 6 to 12 months. During this period, borrowers may pay simple interest to reduce the overall loan burden, though this is optional.

Collateral Requirements

Collateral is often required for larger loans:

- SBI: No collateral for loans up to ₹7.5 lakh; tangible security (e.g., property, fixed deposits) for higher amounts.

- HDFC: Collateral may be required for loans above ₹7.5 lakh, depending on the profile.

- Axis Bank: No collateral for loans up to ₹7.5 lakh; negotiable for higher amounts.

- PNB: No collateral for loans up to ₹7.5 lakh under certain schemes; collateral required for larger loans.

Repayment Tenure

Repayment tenures typically range from 10 to 15 years, with HDFC and Axis offering up to 15 years, SBI up to 15 years, and PNB up to 15 years for most schemes.

Customer Service and Support

The ease of application, disbursal speed, and ongoing support vary by bank. HDFC is known for fast disbursal, while SBI and PNB, being public sector banks, have extensive branch networks. Axis Bank offers pre-admission sanctions, which can be beneficial for planning.

Case Studies: Comparing Loan Costs

To illustrate the differences, let’s examine two hypothetical scenarios for a student borrowing for higher education.

Scenario 1: Studies in India (₹10 Lakh Loan, 10-Year Tenure)

Assume a student needs a ₹10 lakh loan for a course in India, with a 10-year repayment tenure after a 2-year moratorium.

| Bank | Interest Rate | Processing Fee | Approx. EMI | Total Interest Paid |

|---|---|---|---|---|

| SBI | 10.70% | Nil | ₹13,200 | ₹5,84,000 |

| HDFC | 10.50% | Nil | ₹13,100 | ₹5,72,000 |

| Axis Bank | 13.70% | 2% (₹20,000) | ₹15,300 | ₹8,36,000 |

| PNB | 10.50% | 1% (₹10,000) | ₹13,100 | ₹5,72,000 |

Analysis: HDFC and PNB offer slightly lower interest rates, making them cost-effective. Axis Bank’s higher rate and processing fee result in a significantly higher total cost.

Scenario 2: Studies Abroad (₹30 Lakh Loan, 15-Year Tenure)

Assume a student needs a ₹30 lakh loan for a course abroad, with a 15-year repayment tenure after a 3-year moratorium.

| Bank | Interest Rate | Processing Fee | Approx. EMI | Total Interest Paid |

|---|---|---|---|---|

| SBI | 10.15% | Nil (assumed) | ₹32,200 | ₹27,96,000 |

| HDFC | 11.00% | 2% (₹60,000) | ₹33,900 | ₹31,02,000 |

| Axis Bank | 9.99% | 2% (₹60,000) | ₹31,900 | ₹27,42,000 |

| PNB | 10.50% | 1% (₹30,000) | ₹32,900 | ₹29,22,000 |

Analysis: Axis Bank offers the lowest interest rate, making it the most cost-effective for abroad studies, followed closely by SBI. HDFC’s higher rate increases the total cost.

Note: EMI and interest calculations are approximate and based on standard EMI calculators. Actual values may vary based on specific terms and conditions.

How to Choose the Right Education Loan

Selecting the best education loan involves more than just comparing interest rates. Here are some tips to guide your decision:

- Compare All Costs: Look at interest rates, processing fees, and other charges to understand the total cost of borrowing.

- Check Concessions: Many banks offer discounts (e.g., 0.50% for female students at SBI and PNB) or interest subsidies under government schemes like CSIS or Padho Pardesh.

- Evaluate Loan Limits: Ensure the loan amount covers all expenses, including tuition, accommodation, and travel (especially for abroad studies).

- Understand Collateral Requirements: For larger loans, check what collateral is needed and whether you can meet these requirements.

- Use EMI Calculators: Tools like the SBI Education Loan EMI Calculator or PNB EMI Calculator help estimate monthly payments.

- Research Bank Reputation: Consider the bank’s customer service, disbursal speed, and branch accessibility.

- Explore Government Schemes: Schemes like CSIS (for family income ≤ ₹4.5 lakh) or Padho Pardesh (for minority students) can reduce the financial burden.

Application Process

Applying for an education loan typically involves the following steps:

- Research and Compare: Visit the official websites of SBI, HDFC, Axis, and PNB to review loan schemes and eligibility criteria.

- Gather Documents: Common documents include:

- Admission letter from the institution.

- Academic records (10th, 12th, graduation marksheets).

- Identity and address proof (Aadhaar, PAN, passport).

- Income proof of co-applicant (salary slips, IT returns).

- Collateral documents (if applicable).

- Apply Online or Offline: Most banks offer online applications through their portals (e.g., SBI Education Loan Portal) or require in-person submission at a branch.

- Loan Sanction and Disbursal: After verification, the loan is sanctioned, and funds are disbursed directly to the institution or student’s account.

Government Schemes and Subsidies

Several government initiatives can make education loans more affordable:

- Central Sector Interest Subsidy Scheme (CSIS): Offers full interest subsidy during the moratorium period for students with family income up to ₹4.5 lakh, applicable for loans up to ₹7.5 lakh.

- Padho Pardesh Scheme: Provides interest subsidy for minority community students with family income up to ₹6 lakh, primarily for abroad studies.

- Dr. Ambedkar Interest Subsidy Scheme: Similar benefits for OBC and EBC students.

Check eligibility on the Vidya Lakshmi Portal for these schemes.

Conclusion

Choosing the right education loan requires balancing interest rates, processing fees, loan limits, and repayment terms. SBI stands out for its low rates, especially for premier institutions, while HDFC offers flexibility and fast disbursal. Axis Bank is competitive for abroad studies, and PNB provides attractive options for both India and abroad. The best choice depends on your specific needs, such as the course, institution, and financial situation. Always verify the latest rates and terms directly with the banks, as they can change based on market conditions and individual profiles. By carefully comparing these factors and leveraging tools like EMI calculators, students can secure a loan that supports their academic journey without undue financial strain.

FAQs

- What are the interest rates for SBI education loans in 2025?

- Rates range from 8.15% to 11.15%, depending on the scheme (e.g., 8.15%-8.90% for Scholar Loan, 10.15%-11.15% for Student Loan).

- Does HDFC Bank offer education loans for studies abroad?

- Yes, HDFC provides loans for international studies with rates from 9.55% to 13.25%, based on the course and applicant profile.

- What is the processing fee for Axis Bank education loans?

- Axis Bank charges up to 2% of the loan amount plus GST.

- Can I get a PNB education loan without collateral?

- Yes, for loans up to ₹7.5 lakh under schemes like PNB Saraswati or Udaan, collateral may not be required, subject to terms.

- Are there any government subsidies for education loans?

- Yes, schemes like CSIS and Padho Pardesh offer interest subsidies for eligible students. Check the Vidya Lakshmi Portal for details.

1 thought on “Comparing SBI Education Loan Interest Rates with HDFC, Axis, and PNB in 2025”