In 2025, business formations are surging, with U.S. Census Bureau data showing a 12% uptick in new LLC registrations compared to last year—driven by remote work booms and AI side hustles. If you’re an aspiring entrepreneur juggling a day job or dreaming of scaling a freelance gig into a full empire, forming a Limited Liability Company (LLC) isn’t just smart—it’s essential. It shields your personal assets from business debts while offering tax flexibility that sole proprietorships can’t match.

This guide breaks it down into actionable steps, blending timeless advice with fresh 2025 trends like Wyoming’s privacy perks and Delaware’s investor appeal. Whether you’re a tech-savvy millennial launching an e-commerce store or a Gen X parent turning a passion project into profit, you’ll walk away ready to file. Let’s dive in—your business breakthrough starts now.

Why Form an LLC in 2025? The Timely Edge

Evergreen appeal meets hot trends: LLCs have protected over 2 million U.S. businesses since the 1990s, but 2025 flips the script with economic shifts. Inflation cooling to 2.5% has entrepreneurs flocking to formal structures for credibility and funding access.

- Booming Formations: April 2025 saw a 15% spike in filings, per Census stats, fueled by gig economy pros formalizing under new IRS remote-work deductions.

- State Showdown: Wyoming leads for privacy (no public owner disclosure), while Delaware dominates for venture capital—perfect if you’re eyeing investors.

- Tech Twist: AI tools now automate 70% of paperwork, slashing setup time to days, not weeks.

Bottom line? In a year of economic optimism, an LLC isn’t a hurdle—it’s your launchpad. Costs average $100–$800 statewide, with ROI in liability protection alone.

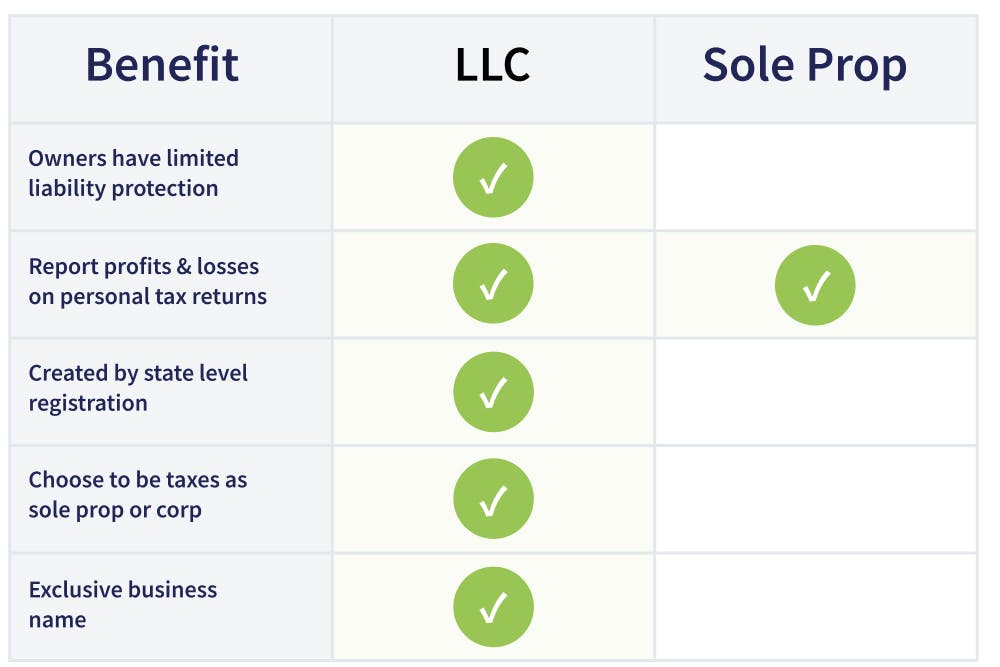

LLC vs. Other Structures: Quick Comparison

Before filing, weigh options. LLCs strike a balance: easier than corporations, safer than sole props.

| Feature | LLC | Sole Proprietorship | Corporation |

|---|---|---|---|

| Liability Protection | High (personal assets safe) | None (unlimited risk) | High (but more formal) |

| Tax Flexibility | Pass-through (default) | Pass-through | Double taxation (C-Corp) |

| Setup Cost (2025 Avg.) | $100–$500 | $0 | $500–$2,000 |

| Ideal For | Small teams, freelancers | Solo starters | Scaling with investors |

Data from IRS and Forbes shows 80% of new businesses choose LLCs for this mix. Trending now: Hybrid LLCs blending with DAOs for crypto ventures.

New Jersey LLC vs. Sole Proprietorship | LLC Attorney

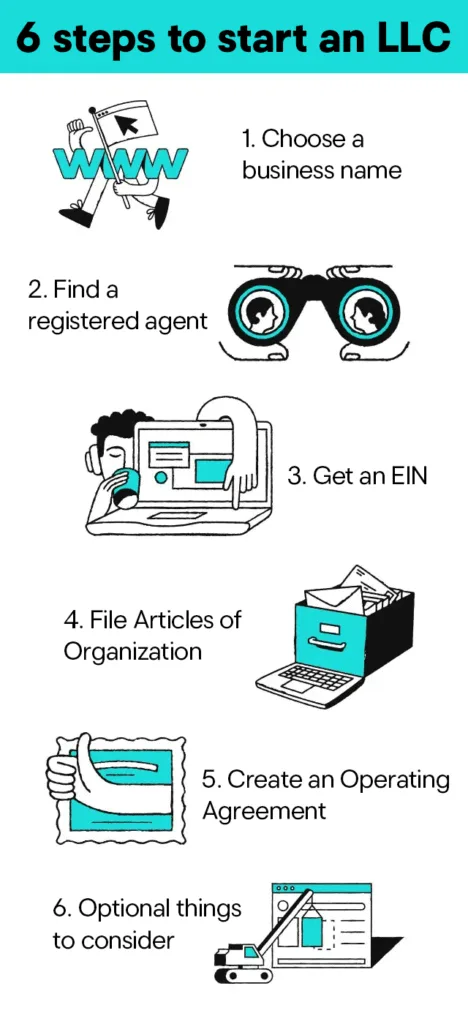

Step 1: Choose a Winning Business Name

Your LLC’s name is its first impression—and a legal must. It must be unique, include “LLC” or “Limited Liability Company,” and avoid restricted words like “bank” without approval.

- Brainstorm Smart: Use tools like Namecheap for availability checks. In 2025, incorporate trends—think “EcoThreadLLC” for sustainable fashion.

- State Search: Query your Secretary of State’s database (e.g., California’s BizFile Online).

- Trademark It: File with USPTO for $250–$350 to block copycats nationwide.

Pro Tip: Reserve your name for 30–120 days (fees: $10–$50) while you prep. Fresh insight: With domain squatters rising 20% in 2025, snag your .com early via GoDaddy.

Step 2: Appoint a Registered Agent

This is your LLC’s legal mailbox—someone (or a service) to receive lawsuits and state notices. You can’t be your own if your address is public-facing.

- Who Qualifies?: A U.S. resident or entity in your formation state, available weekdays 9–5.

- DIY vs. Pro: Solo? Use yourself. Scaling? Hire Northwest Registered Agent ($125/year) for privacy.

- 2025 Trend: Virtual agents surged 25% post-pandemic, offering mail scanning apps for nomads.

Miss this? Your filing gets rejected. Cost: Free if self, $50–$300 annually otherwise.

Step 3: File Articles of Organization

The official birth certificate. Submit to your state’s Secretary of State—online for speed.

- What to Include: Name, address, agent, management structure (member- or manager-managed).

- Fees Breakdown:

- California: $70 + $800 annual tax.

- Texas: $300 flat.

- Delaware: $90 (investor-friendly low).

- Timeline: 1–2 weeks approval; expedited for $50–$500.

Evergreen hack: Use services like LegalZoom ($0 + state fees) for error-proof filing. In 2025, AI-powered platforms like ZenBusiness cut errors by 40%.

Signing an Important Contract During a Business Meeting in a Modern Office Space in the Afternoon 60294726 Stock Photo at Vecteezy

Step 4: Draft an Operating Agreement

Not always required, but vital—outlines ownership, profits, and disputes. Think prenup for your business.

- Key Sections: Member roles, voting rights, dissolution rules.

- Templates: Free from SBA.gov, customize via Rocket Lawyer ($39.99).

- Multi-Member Must: Prevents 2025’s rising co-founder lawsuits (up 18% per legal reports).

Internal doc—no filing needed. Skip it? Default state laws apply, risking chaos.

Step 5: Get Your EIN (Employer ID Number)

The IRS’s social security for businesses. Free, instant online.

- Why Now?: Needed for banking, hiring, taxes—even solo LLCs.

- Apply: IRS.gov takes 5 minutes; no SSN? Use ITIN.

- Trend Alert: With freelance taxes tightening, EINs enable 1099 tracking apps like QuickBooks (2025 integration with AI forecasting).

No EIN? No business bank account—huge red flag for lenders.

Step 6: Open a Business Bank Account & Handle Licenses

Separate finances to maintain liability shield. Plus, snag permits.

- Bank Picks: Chase or Novo for low-fee LLC accounts (0% intro APR in 2025 promos).

- Licenses Vary: Sales tax permit (free via state revenue depts.), professional licenses for niches like consulting.

- Compliance Check: Use SBA’s license finder tool.

Fresh stat: 65% of new LLCs fail audits without dedicated accounts—don’t join them.

Step 7: Set Up Taxes & Ongoing Compliance

LLCs default to pass-through taxation (profits on personal returns), but elect S-Corp for savings if profits top $50K.

- Federal: Schedule C on Form 1040; deduct home office (up to $1,500 in 2025).

- State Nuances: Annual reports ($25–$500); California’s franchise tax hit $800 minimum.

- Tools: TurboTax Business for seamless filing.

2025 Insight: New IRS AI audits flag 30% more discrepancies—proactive bookkeeping via Xero pays off.

Common Pitfalls: Avoid These 2025 Traps

Even pros slip. Here’s a flowchart-inspired rundown of errors to sidestep—drawn from real founder stories.

- Name Oversights: Forgetting “LLC” suffix or trademark clashes (costs $5K+ to fix).

- Agent Lapses: Using out-of-state help without foreign qualification (fines up to $1,000).

- Tax Blunders: Missing S-Corp election deadline (March 15)—losing 15% savings.

- Agreement Gaps: Vague profit shares spark 2025’s co-founder exodus wave.

Bulletproof: Consult Nolo’s guides or a $200 attorney review.

Flowchart Guidelines to Avoid 15 Common Flowchart Mistakes

Costs Breakdown: Budget for Your Launch

Total startup: $200–$1,000, but here’s the 2025 scoop:

- Formation Fees: $50–$500 (state-dependent).

- Agent Service: $100–$300/year.

- EIN/Licenses: Free–$100.

- Legal Help: $0 (DIY) to $1,000 (full service).

Savings Hack: Bundles from IncFile drop to $0 + fees, with 2025’s economic perks like fee waivers in growth states. ROI? Liability alone saves thousands in potential lawsuits.

Trending LLC Niches for 2025 Growth

Evergreen stability + timely hooks: Capitalize on surges.

- Sustainable Ventures: Eco-LLCs qualify for $10K green grants.

- AI Consultancies: Privacy-focused Wyoming LLCs hide IP from competitors.

- E-Com Side Hustles: Shopify integrations make tax compliance seamless.

Per TRUiC, these niches see 25% higher survival rates. Your edge? Start lean, scale smart.

54,300+ Small Business Celebration Stock Photos, Pictures & Royalty-Free Images – iStock | Small business party, Small business success, Growing business

FAQ: Your LLC Questions Answered

Q: How long does it take to start an LLC in 2025? A: 1–4 weeks, but online filings in states like Delaware approve in 1–2 days.

Q: Can a non-U.S. resident form an LLC? A: Yes, via services like MyUSACorporation—no SSN needed, but expect extra compliance.

Q: What’s the best state for my LLC? A: Delaware for investors, Wyoming for privacy, home state for simplicity. Avoid high-tax spots like California unless rooted there.

Q: Do I need a lawyer? A: Not always—DIY 70% of cases via SBA resources. Hire for complex multis ($500–$2,000).

Q: How do LLC taxes work in 2025? A: Pass-through by default; elect C-Corp for deductions. Watch new remote-work credits saving up to $5K.

Q: Can I convert a sole prop to an LLC? A: Yes—file articles and transfer assets. Minimal taxes if done right; use IRS Form 8832.

Q: What’s next after formation? A: EIN, bank account, marketing. Track with apps like FreshBooks for 2025’s audit-proof records.

Ready to Launch? Your Next Move

You’ve got the blueprint—now execute. In 2025’s entrepreneur gold rush, an LLC isn’t optional; it’s your unfair advantage. Start with your state’s site (e.g., sos.ca.gov for Cali) or a service like LegalZoom for hand-holding. Celebrate that first filing like the milestone it is.

Sources: IRS.gov, SBA.gov, Forbes Advisor, LegalZoom, U.S. Census Bureau.

yanatec.in Best ai for image generation of 2025, New car and bike update, ArtCAM 2018 and tech news, software reviews update.